SAJ-99

Well-known member

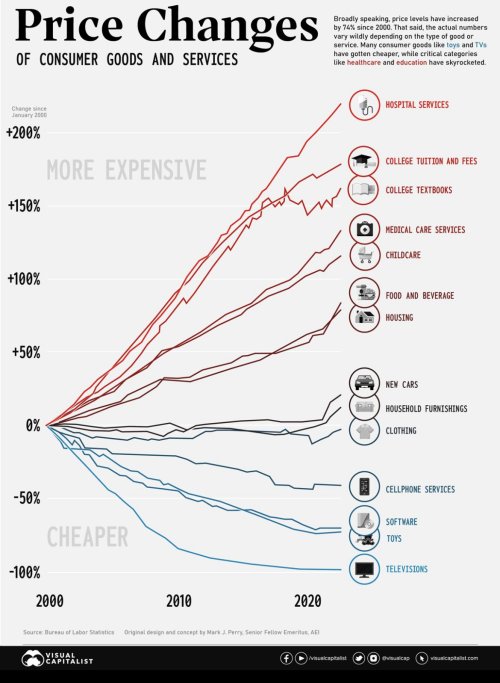

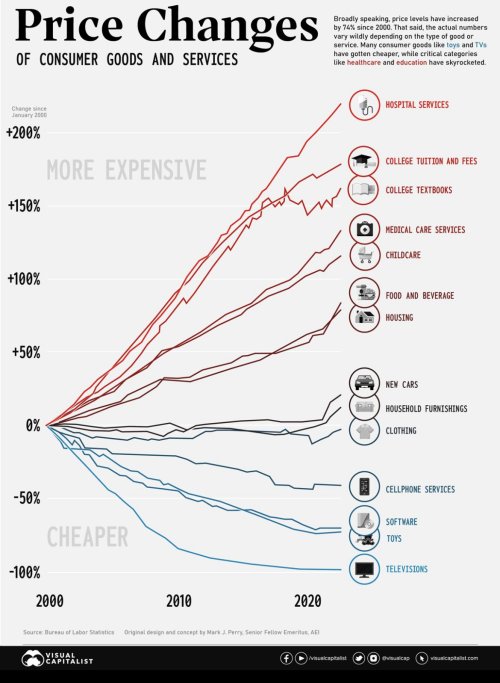

Interesting chart on the inflation of various components over the last 20+ years. Ties in with @VikingsGuy thread on student loan relief. You can argue almost anything that fits your belief. The highest inflation is in those items that have a heavy government subsidy. But also those things that can’t be easily outsourced to other countries.