SAJ-99

Well-known member

The analogy to Tarp is most relevant in that we act like farmers should never fail these days and some farmers should definitely fail because they are terrible farmers or make multiple bad decisions (just like some financial institutions did stupid shit causing the bailout)! Should all businesses succeed? Are your investments guaranteed not to lose? Do you get to ignore contracts and agreements you sign? Cadillac crop insurance has made farming almost fail-proof. I'm not against the option to buy crop insurance, I just figure that when farmers who already get huge tax breaks and receive Govt subsidies are being told by their advisors they have to buy a new truck (when they are currently driving a 2 yr old truck), tractor, grain bin, etc this year to avoid paying taxes to the Federal Government, they should be covering 100% of their own insurance. That would free up some money to increase CRP payments. Start enforcing existing wetland drainage laws and that would free up the subsidies that those farmers receive; a hundred million here and there, coupled with some innovative partnerships and pretty soon you can afford a habitat program that pays a fair price. It would basically just be redistributing the money back to farmers anyway, only society would be getting something in return. BTW: Ranchers, who at least keep grass on the landscape, sure do get the short end of the stick compared to grain farmers huh?

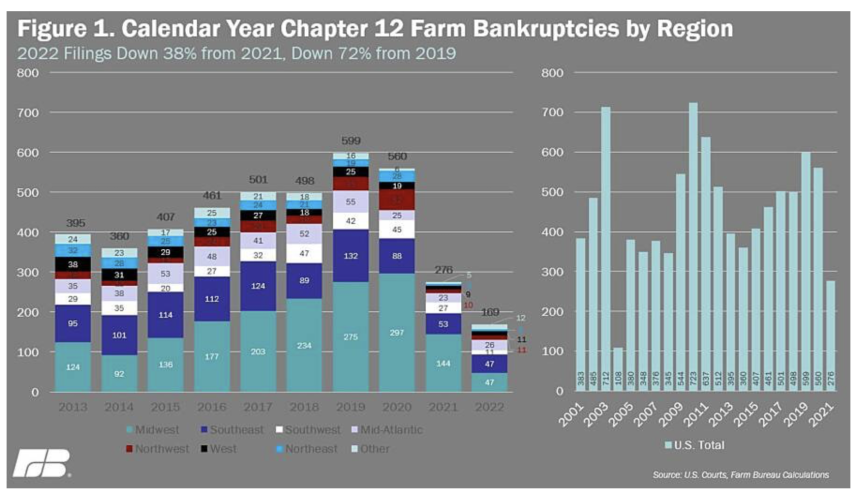

I don't think you have a clear understanding of insurance. While I know I'm not going to get you off your rant, insurance doesn't prevent failures due to bad decisions (it didn't in TARP either). It tries to prevent massive failures (that often will affect us all) due to events outside the control of the insured. What you see below is the upside to commodities inflation and farm consolidation.