Looking for a crash course, Housing Market 101.

How to gauge the crystal ball for future housing valuation...

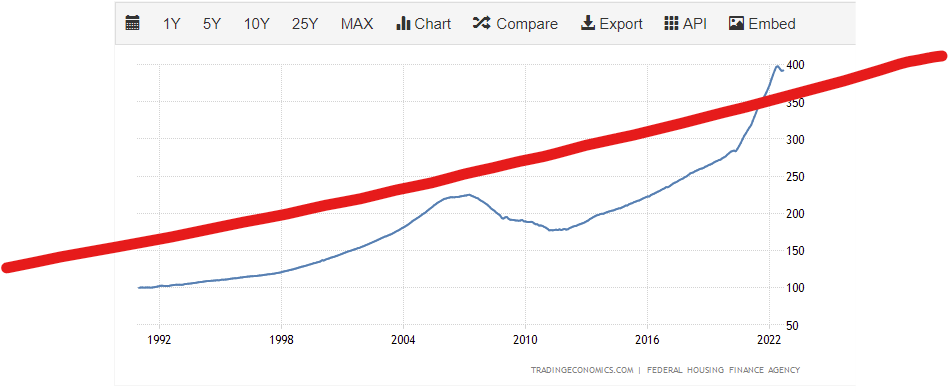

Working within these sites for statistics... Based on what I see (as a rookie), It appears 2027-2028 may be an approximate time frame for the historical value to reach our recent peak home sales(?)...

Head/tails of where we were, are, and will be for the purchase of houses - future real estate valuations moving forward?

Real estate has always been a dependable "nest egg". Thoughts on the housing market?

Sites used:

www.nar.realtor

www.nar.realtor

tradingeconomics.com

tradingeconomics.com

How to gauge the crystal ball for future housing valuation...

Working within these sites for statistics... Based on what I see (as a rookie), It appears 2027-2028 may be an approximate time frame for the historical value to reach our recent peak home sales(?)...

Head/tails of where we were, are, and will be for the purchase of houses - future real estate valuations moving forward?

Real estate has always been a dependable "nest egg". Thoughts on the housing market?

Sites used:

Housing Statistics and Real Estate Market Trends

NAR provides housing statistics and real estate market trends on the national, regional, and metro-market level where data is available.

United States FHFA House Price Index

Housing Index in the United States decreased to 417.49 points in January from 417.79 points in December of 2023. This page provides the latest reported value for - United States House Price Index MoM Change - plus previous releases, historical high and low, short-term forecast and long-term...