VikingsGuy

Well-known member

True “peak oil” (for the 50th time) or a natural artifact of Wall Street reluctance to fund and fed’s reluctance to permit new wells?

www.wsj.com

www.wsj.com

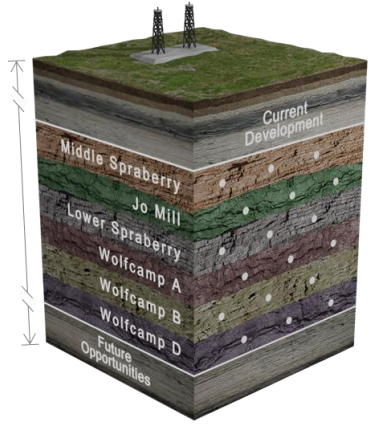

U.S. Shale Boom Shows Signs of Peaking as Big Oil Wells Disappear

America’s biggest oil gushers are shrinking, evidence that companies have drilled through much of their best wells and are poised to reach a plateau in productivity.